If you have been turned down for a traditional auto loan here is what those numbers that appear in credit denial notices mean as well as what can be done if you have problem credit

What we know

Consumers with bad credit that have applied for a regular car loan sometimes find the FICO reason codes in the "adverse action notice requirements" they receive confusing. But this is an improvement over the old system.

At least that's our opinion here at Auto Credit Express where, for over two decades, we've been helping car buyers with poor credit searching for online auto loans find those new car dealers that can offer them their best chances for credit approvals.

During the past twenty years in the car business we've seen improvements in the credit decision process. In fact, before a recent financial reforms package with new lender requirements became law, it was often difficult for credit-challenged car shoppers to understand why a lender had rejected their loan application.

Notice requirements and reason codes

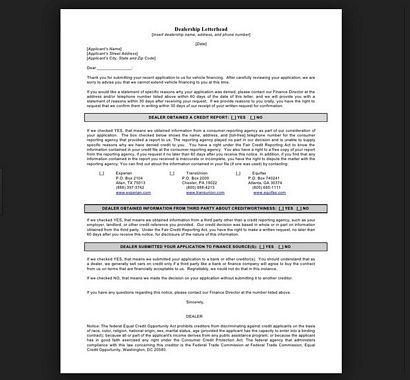

Recent financial reforms now require that credit grantors send applicants a risk-based pricing notice that must include, as FICO puts it, "The key factors or reason codes that adversely affected the credit score, with a requirement to disclose five 'reason codes' any time inquiries are a 'key factor' that adversely affected the score."

To help credit applicants understand why they were turned down for any type of loan, FICO created 40 "reason codes" that explain why a consumer was either turned down or, if accepted, why the applicant failed to qualify for the best interest rates offered by a particular lender.

All three major credit reporting agencies use this system, although they sometimes assign different "code numbers" to the reasons and not every bureau uses every reason code.

This being the case, we put together the complete list of reasons. Next to each reason we've listed three code numbers. The code number used by Equifax is listed first, TransUnion second and Experian third. If a bureau doesn't use that particular reason, an "N/A" is shown in that bureau's place:

Amount owed on accounts is too high – 1,1,1

Level of delinquency on accounts – 2,2,2

Too few bank revolving accounts - 3,N/A,3

Too many bank or national revolving accounts – 4,N/A, 4

Too many accounts with balances – 5,5,5

Too many consumer finance company accounts – 6,6,6

Account payment history is too new to rate- 7,7,7

Too many recent inquiries last 12 months – 8,8,8

Too many accounts recently opened – 9,9,9

Proportion of balances to credit limits is too high on bank revolving or other revolving accounts – 10,10,10

Amount owed on revolving accounts is too high – 11,11,11

Length of time revolving accounts have been established – 12,12,12

Time since delinquency is too recent or unknown – 13,13,13

Length of time accounts have been established – 14,14,14

Lack of recent bank revolving information – 15,15,15

Lack of recent revolving account information – 16,16,16

No recent non-mortgage balance information – 17,17,17

Number of accounts with delinquency – 18,18,18

Date of last inquiry too recent – N/A, 19, N/A

Too few accounts currently paid as agreed – 19,27,19

Length of time since derogatory public record or collection is too short – 20,20,20 Amount past due on accounts – 21,21,21

Serious delinquency, derogatory public record or collection filed – 22,22,22

Number of bank or national revolving accounts with balances - 23,N/A, 23

No recent revolving balances – 24,24,24

Number of revolving accounts – 26,N/A,26

Number of established accounts – 28,28,28

No recent bankcard balances – N/A,29,29

Time since most recent account opening too short – 30,30,30

Too few accounts with recent payment information – 31,N/A,31

Lack of recent installment loan information – 32,4,32

Proportion of loan balances to loan amounts is too high – 33,3,33

Amount owed on delinquent accounts – 34,31,34

Serious delinquency and public record or collection filed – 38,38,38

Serious delinquency – 39,39,39

Derogatory public record or collection filed – 40,40,40

Checking this list against a risk-based pricing notice, consumers should be able to figure out why they were either turned down or failed to qualify for the lowest interest rate offered by the lender.

How we can help

If the credit denial you received was for a conventional auto loan we want you to know that for most applicants this is not the end of the road. In fact, there's a good chance a BHPH car loan isn't the only other option for getting financed for a car with questionable credit.

That's because Auto Credit Express matches people that have experienced difficulties with their car credit to those new car dealers that can offer them their best chances for auto loan approvals.

So if you find yourself in this situation and you're ready to reestablish your auto credit, you can begin now by filling out our online auto loan application.