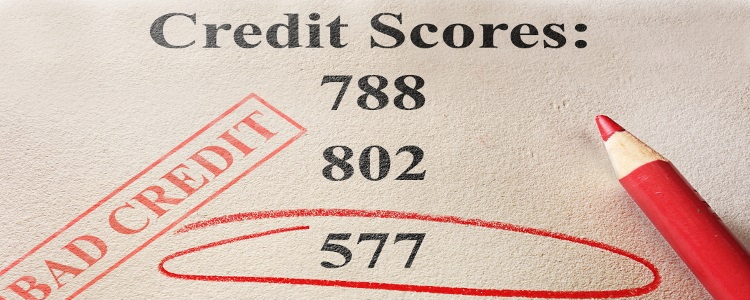

If you have been turned down for an auto loan, it may be due to problems with your credit history. Having either damaged credit or little to no credit can make it difficult to get approved for financing. But you may be wondering why your credit rating is so important to lenders. If you have bad credit, why can't they just let the past be the past? And if you're struggling to build credit, why can't they give you a chance to get started?

Assessing Your Risk Potential as a Borrower

When you apply for a car loan (or any other type of loan or line of credit), the lender that reviews your application will want to know how likely you are to pay back what you're borrowing. And the only resource that the lender can reasonably consult is your credit report. By viewing this document, they are able to see how you have handled payments in the past, and this information will give them of an idea as to how you will manage future financial responsibilities. Having any of the following on your credit report would normally disqualify you from either getting a loan or qualifying for the best interest rates:

- Bankruptcy

- Repossession

- Charge-Offs

- Accounts in Collections

- Multiple Tardy Payments

- Too Many Open Accounts

Also, if you have little or no credit history to speak of, lenders have no way of assessing your borrowing habits. While there is no reason for them to suspect that lending to you would be risky, there is also no proof that you will be making timely payments. This is why having no credit (or a "thin file") is almost as bad as having poor credit.

Getting a Loan with Bad or No Credit

While it may be difficult to obtain financing from a bank or a credit union with bad credit, there are lending resources available to the credit challenged.

Buy Here Pay Here (BHPH) Dealerships: BHPH dealers handle all financing "in house," and do not use the services of third party lenders. This means that they have the power to approve financing for anyone they choose, and they typically will approve you if you have a down payment, can provide verification of consistent income, a driver's license and proof of legal residency. And, chances are, your credit won't even be checked.

Qualified Special Finance Dealers: Certain dealers work with lenders that are willing to offer loans to credit challenged buyers. And getting approved through one of these dealers is a good way to get the transportation that you need and start building/rebuilding your credit at the same time.

Finding the Dealer that Can Help

The easiest way to locate a dealer that can connect you with the right lender is through the finance experts at Auto Credit Express. We will match you with a dealer in your area that can help you find an auto loan solution that works, in most cases regardless of what your credit situation looks like. Just fill out our fast and secure online application to get started today.