Negative items, like a late payment or foreclosure, can stay on your credit report for up to seven or ten years. Because we are now seven years removed from the Great Recession, FICO conducted a study to look at how credit scores are impacted after negative information is removed from credit reports.

FICO Performs a Study

The effects of the recession from the late 2000s were widespread. Unemployment dipped along with median household income. Many consumers wound up with credit black marks as a result of missed payments, foreclosures, personal bankruptcies, and more.

The Recession officially ended in June of 2009. Since derogatory marks are removed from credit reports after seven or ten years, many of them are starting to be purged from consumers' credit reports right around now.

FICO wanted to examine the impact the removal of negative information would have on the credit scores of these consumers. So, they conducted a study.

According to them, some 28 million U.S. consumers had a serious late payment delinquency (90 days or more past due) between 2009 and 2010. They took a random sample from those consumers and divided them into two groups:

- Consumers who had a delinquency removed from their credit report between May and July of 2016. FICO calls this group the "delinquency purge" population.

- Those who had a serious delinquency between 2009 and 2010, but one that was not removed from their credit report between May and July of 2016. FICO refers to this group as the "delinquency baseline" population.

FICO's Findings

Let's breakdown what FICO learned from their study.

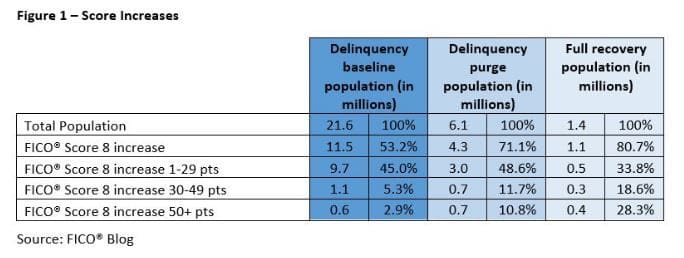

First, having a serious delinquency fall off was correlated with credit score improvements. The average score in the "delinquency purge" group (those who had a serious delinquency removed) increased by 14 points. FICO was surprised at how low that number was.

The positive change was found to be even greater for consumers who had all of their serious delinquencies removed between the May and July 2016 time period. FICO is calling this group the "full recovery" population. The average score increase for this group was 33 points. In addition, 28.3% of this group saw their score increase by 50 points or more.

Meanwhile, 53.2% of the "delinquency baseline" consumers (those whose serious delinquencies were not removed during the reviewed time period) saw there FICO scores increase . However, the score hikes were almost all moderate - 45% of them saw their score increase between 1 and 29 points.

Here is a graph that charts the three groups FICO tracked and how consumers' credit scores changed.

Takeaways

Here are some things we learned from this FICO study.

- Unsurprisingly, having a serious delinquency taken off your credit report was positively linked to an increase in your credit score.

- However, the impact of a removed delinquency was small (although FICO only examined score changes over a short three-month period).

Keep in mind that a lot more can be going on with a person's credit at the same time negative information is being removed. For example, other bad credit habits could be keeping their scores low even as a delinquency is dropping off. Finally, the further in the past a negative event occurred, the less of an impact it has on your credit rating.

The study shows that you are going to need to take a much more active approach to improving your credit rather than just waiting for negative information to fall off. If you truly want to boost your score, you're going to have to further demonstrate responsible credit management. That entails everything from establishing a strong payment history to keeping credit card balances low.

The Bottom Line

All negative marks come off of your credit report in time, but FICO's study shows that having them fall off usually only makes a small positive impact on your credit score. If you want to go above and beyond that, you'll need to take a more active role in rebuilding your credit.

At the same time, if you have bad credit and need a car, you should know that a subprime auto loan is one of the best credit-building tools around. By making all of your payments on time, you can improve your score and show lenders that you can handle a big-ticket loan.

Auto Credit Express helps consumers dealing with credit problems, including black marks on their credit reports, find car loans. We do this by connecting them to car dealerships in their area that have the lenders and know-how to help people dealing with credit problems.

We may be able to help you next. Get the process started by filling out our free, simple and secure car loan request form.