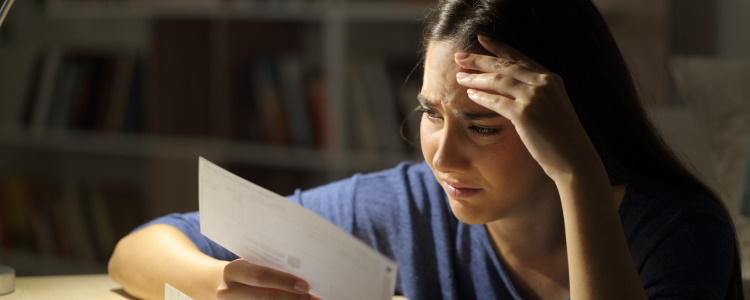

There’s nothing saying you can’t apply for an auto loan immediately after a repo, but the tough part is actually being able to qualify for the loan. Since many auto lenders don’t approve borrowers with a repo that’s less than a year old, you may have to consider in-house financing.

Repossessions and Your Next Car Loan

Unfortunately, most traditional auto lenders don’t work with borrowers that have a recent repo on their credit reports. When we say traditional, we’re referring to lending institutions such as banks, credit unions, online lenders, and the captive lenders of some automakers. These lenders often require a good credit score and clean credit reports.

Where does that leave you? Well, likely in-house financing is the next logical step if you need a car loan after a repossession.

More on In-House Financing

Buy here pay here (BHPH) dealerships use in-house financing. This way of auto financing involves working with the dealer who’s also your lender. There’s no need to find a third-party lender or preapproval – the dealer takes care of all that. This setup can be convenient, and often, borrowers are able to walk away with a vehicle the same day they first set foot on the lot.

Since these dealers may not check your credit reports to determine your eligibility for auto financing, your recent repossession generally isn’t an issue. If you can meet income requirements, prove you have stable work, secure auto insurance, and prove your identity, you might get into a vehicle after a repo with in-house financing.

Here are a few more details on in-house financing:

- Used cars only – BHPH dealers only offer used vehicles. However, used cars are a good option for bad credit borrowers. They’re almost always less expensive than a brand-new car, and affordable is a good price when you need to get back on your feet after a repo.

- Anticipate a higher interest rate – Without a credit check, lenders are taking a risk approving a car loan without knowing much about your credit history. To make up for this, they tend to assign higher interest rates. A high interest rate may be considered a good trade-off for an auto loan with bad credit in many cases, especially if you heavily rely on a vehicle to get by.

- Credit repair may not be an option – If you get an auto loan with a lender that doesn’t check your credit, it’s a possibility that your on-time payments aren’t going to be reported to the credit bureaus. If you want to repair your credit with a car loan, ask the lender about their credit reporting practices before you sign on the dotted line.

- Down payments are required – Few things are certain in the auto lending world, but one thing you can count on is needing a down payment if your credit is less than perfect. BHPH dealers often require a down payment of up to 20% of the vehicle’s selling price.

- Prepare your documents – While a BHPH dealer may not check your credit, they’re likely to ask about your income and possibly your work history. You need proof of income to qualify for a car loan, no matter what lender you work with, so prepare at least a month of computer-generated check stubs. If you don’t have W-2 income, have copies of your last two to three years of tax returns.

Looking Forward After a Repo

After one year, your auto loan options open up a little bit more and you’re more likely to qualify for a subprime car loan. Subprime lenders are equipped to assist bad credit borrowers. These lenders offer you a chance for credit repair because they report their loans and work with poor credit borrowers.

If you need a vehicle quickly, a BHPH dealership could be your first step in getting back on the road. Once some time has passed, and your repossession loses some impact on your credit reports, you can try for an auto loan that has the potential to repair your credit.

Here at Auto Credit Express, we know a thing or two about bad credit auto loans, and we have a nationwide network of dealerships that assist bad credit borrowers. We aim to match consumers to dealers in their local area that help with credit challenges. If you’re in need of auto financing, start right now by filling out our free auto loan request form. We’ll look for a dealer in your local area at no cost and with no obligation.