After all the holiday celebrations are over and you've rung in the New Year with good friends and family, it's time to start thinking about filing your 2013 tax returns. Each year, many people rely on their tax refunds to get approved to buy a car with auto financing. Unfortunately, in recent years, many of those people have found that their tax identity was stolen and getting their money back took months of wrangling with the IRS. As early as 2005, identity theft made up more than 39 percent of the consumer fraud complaints, and that number climbs every year.

Understanding Tax-related Identity Theft

For this coming tax season, the Federal Trade Commission (FTC) has embarked on a public information campaign, declaring January 13-17, 2014 to be Tax Identity Theft Awareness Week with the goal of helping people protect themselves from fraud and receive the compensation the IRS owes them.

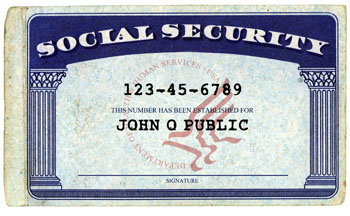

What is tax-related identity theft and how can you tell if you are the victim of this crime. First, you should know that an identity thief gets a hold of your Social Security number and uses that information for several purposes including:

- Hijacking Your Tax Return - If someone uses your SS number and files a tax return before you do, they'll likely get your refund. Then, when you go to file, the IRS will notice a return has already come in and will send you a notice that more than one return was filed for your identity.

- Getting a Job - When a thief uses your SSN to gain employment, that person's employer will report their income to the IRS. When you go to file your return and it doesn't include the income from that employer's W-4 form, the Internal Revenue Service will send you a notice that you failed to include that money in calculating your taxes for the year.

These are two sure signs that your identity has been stolen, and, while it can be disconcerting at first, the important thing to do is remain calm. Just remember, there are steps you can take to resolve the issue and avoid ending up with a bad credit score that hangs on your report for what can be a long time. If this happens, when the time comes to purchase another vehicle, you might have to look for auto loans for bad credit at a local car dealership.

Steps for Handling Tax-related Identity Theft If It Happens To You

The first thing you are going to want to do is contact the IRS' Identity Protection Unit at 800-908-4490. When you call this number, you'll speak with a specialist who can take your fraud completing. Then you are going to either file a report with your local police department or fill out IRS ID Theft Affidavit Form 14039, which you can download from their website. Then you'll send the IRS whichever of these documents you have along with proof of your who you are, such as a copy of your Social Security card, your driver's license or a copy of your passport.

While you are doing these things, you are going to want to make sure you keep a file that records all of your activity - details and dates of who you spoke with, documentation you mailed, etc. And don't forget to keep a copy of all the letters you send out.

More Steps To Repair Identity Theft

Once you have started the process rolling with the IRS, there are a few other things you can do protect yourself and repair any damage to your financial reputation that has occurred. These step include:

- Contact the top three credit reporting agencies - Experian, TranUnion and Equifax - to notify them you've been the victim of identity theft. Often if you call one of the bureaus, they will share the information with the other two, but you want to confirm this.

- Have a fraud alert put on your credit file. This let's potential creditors requesting your background know that you have been the victim of identity theft so that they will take extra steps to verify you have approved the request for a line of credit.

- The three agencies will give you a free copy of your credit. You are going to want to look this over to make sure no other unwarranted activity has been attached to your name. If you see anything unexpected, contact the bureaus and they will assist you in placing notes in your file and contacting the creditors listed with the fraudulent activity.

No one want to be the victim of identity fraud, but the fact is it happens more and more everyday. If your credit scores are suffering because of actions taken in your name by someone else, that doesn't mean you can't get the auto financing you need to purchase a vehicle. It doesn't matter if you have a 500 credit score and only $500 to put down on a car, you can get approved for a car loan today at Auto Credit Express.