Auto Credit Express can match you with the dealership that can approve you for a car loan even if you have imperfect credit. But the subprime auto loan process works a little differently from that of a traditional car loan. One difference is that you need to bring more documentation to the dealer, and we are here to let you know what you'll need.

What Documentation to Bring to the Dealership

What Documents You Should Bring to the Dealership

With any car loan from any lender, you'll be required to furnish documents such as proof of insurance and a valid driver's license. When getting a bad credit auto loan, you'll be required to bring a few additional documents.

If you are wondering why, it is because a lender is taking on a higher risk when funding a subprime auto loan. By requiring extra documentation, the lender is just taking extra care to make sure that the loan is going to be successful for all parties involved.

In the car business, the needed documents are known as stipulations, or "stips" for short. Here is a list of the documentation that subprime lenders recommend that you bring with you when you first go to meet with the finance manager at the dealership:

Your valid driver's license – Valid means that it's not expired, revoked or suspended, and that it lists your current address and is issued by the state in which you reside.

Your valid driver's license – Valid means that it's not expired, revoked or suspended, and that it lists your current address and is issued by the state in which you reside.- Proof of insurance – Make sure to include your agent's name and phone number, but don't add a new car to your auto insurance policy until you have been approved.

- Proof of residency – All you need here is a recent utility bill (water, electric, etc.) with your name on it to verify that you live at the address you provide.

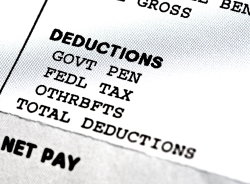

- Proof of employment – You'll need to show a computerized pay stub with your year-to-date earnings on it. It also has to be from within the past 30 days. If you are self-employed, then you need to be prepared to bring up to two years of professionally prepared tax returns.

- A list of personal references – Typically, the finance manager at the dealer wants a list of six references. This can be anybody - a friend, a relative, a coworker - who knows you on a personal level. Provide the name, address, and a phone number for each person. However, none of the references can be listed under the same address. Make sure that you get their permission first because they may be contacted by the lender.

- Phone number verification – The phone number that you provide on the application has be working and in your name. While you can provide your cell phone number, you can't do so if it is a prepaid one.

There are also a few circumstances that require you to bring further documentation.

- If you plan on trading in a vehicle, make sure to bring the title with you.

- If you have completed a bankruptcy, make sure to have the discharge papers with you.

- If you're in an open Chapter 13 bankruptcy, make sure to bring the appropriate paperwork after you have received an Authorization to Incur Additional Debt from the court.

The Benefits of Being Prepared

If you have all of these documents with you when you first meet with the finance manager at the dealership, the loan process can go smoothly. They'll have all of the information their lending partners usually require and they can transmit it over right away. In turn, that allows the loan decision to be made as soon as possible.

Not only will it eliminate the need for you to return to the dealer multiple times, being prepared also puts you in a favorable light. You'll be seen as responsible and extra committed to the purchase, which can only help your case.

Getting Back on the Road

Just as having all of the documents ready allows the loan process to be as efficient as possible, applying with Auto Credit Express can make finding a dealership just as easy. If you have less than perfect credit, we can match you with one in your area that is ready and able to get you back on the road in no time.

All you have to do to get the process started is fill out our secure and obligation-free online application. Start today!

Auto Financing Editor

David is the lead editor for Auto Credit Express with years of experience writing about automotive financing. He was born and raised in Michigan and is a graduate of Michigan State University. David is a skilled writer who contributes to other Internet Brands properties such as CarsDirect and The Car Connection.

Suggested Posts For You

Receive Free Updates

Get the latest credit tips, resources and advice delivered straight to your inbox.