Consumers with credit problems that hope to finance a vehicle while either paying child support or receiving child support income should be aware of how most lenders will treat both situations

Our experience

Car buyers who are responsible for or receive child support income need to know, beforehand, how this might affect their chances for a car loan approval, especially if their credit is less than perfect.

Here at Auto Credit Express we're familiar with both situations because we've spent more than two decades helping people with questionable credit find those new car dealers that can offer them their best opportunities in arranging for an auto loan.

Unfortunately one stumbling block in the process can arise from problems related to child support.

Child support issues

From the start, car buyers with credit problems need to be aware of the fact that most high-risk lenders treat child support payments much differently than regular income. The reason for this is that this type of income cannot be garnished.

What this basically means is that if someone with child support income has difficulty making payments and their car has to be repossessed, a lender can't obtain a court order to garnish those funds it in order to pay any outstanding loan balance once the vehicle is sold.

Since repossession rates on subprime auto loans are higher than normal, lenders who normally work with people that have credit problems are especially careful when considering applicants with this type of income.

But even when child support income is involved, there are at least two situations in which an applicant might have a better chance of getting a loan approval:

1) If an applicant has additional income from a job or other source that can be garnished (the longer the employment time and the higher the income from this source, the better the chances of an approval).

2) If there are contributing factors in support of an applicant such as long-term job or residence stability (living or working in the same area for a number of years) and/or "situational" versus "habitual" bad credit (when the current credit issues are the result of a single event, such as a medical problem as opposed to a history of slow payments), will also increase an applicant's approval chances.

Proof of income

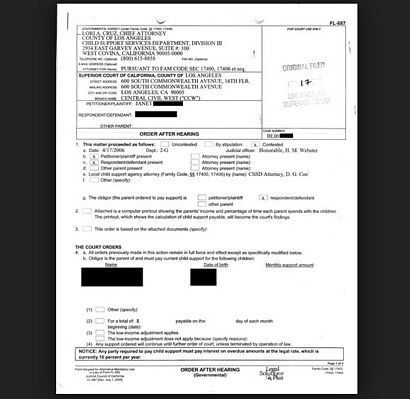

For those receiving payments, proof of the child support income is also a requirement. This means borrowers need to furnish the lender with copies of the court order or divorce decree stating the both the dollar amount and how long the payments are to be made.

Delinquent child support payments

Looking at the other side of the issue, consumers with bruised credit buying a car with child support payments that are delinquent will find it just as difficult getting a loan approval. The reasoning behind this is simple: people in this situation tend to change jobs frequently. In most cases this is due to the fact that when the court finds them at an employer and begins to garnish their paychecks to cover unpaid back payments, these individuals often leave that job for another employer in order to avoid garnishment.

It should also be pointed out that judgments for delinquent child support payments will appear on that individual's credit reports. Upon seeing this information, most lenders will automatically reject an application.

But even in this situation there is usually something that can be done.

In this case, if a delinquency does exist but payment arrangements have been made with child services and this can be proven with written documentation from either child services or the court, then some lenders will still consider the loan application.

As we see it

In the case of child support, both income from it and payment delinquencies for it are a problem with any car loan application but an even bigger issue for buyers with damaged credit. To improve the odds of an approval, be sure to bring the proper documentation with you when you first visit the dealer.

One more thing: at Auto Credit Express we match applicants that have experienced car credit problems with dealers that can offer them their best opportunities for approved car loans.

So if you're ready to establish your auto credit, you can begin now by filling out our online car loans application.