Your bad credit score doesn’t have to be bad forever, and having a lower score can mean running into roadblocks when you’re trying to get into your next auto loan. To repair your credit, it helps to have a checklist of things to work on to prepare for your next car loan. Here are five things you can accomplish to rebuild your credit for an auto loan.

1) Request Copies of Your Credit Reports

Do you know your credit score? Do you know what’s being reported on your credit reports?

Do you know your credit score? Do you know what’s being reported on your credit reports?

If you don’t, don’t fret. You’re entitled to a free copy of each of your credit reports once a week until April 2021 (you can request a copy once every 12 months after this). You can request a free report from each of the three credit reporting agencies – TransUnion, Equifax, and Experian – from www.annualcreditreport.com.

Once you have your reports, review them carefully and see what’s on them. If you see any errors, you can work to correct them. This is called filing a dispute, and you submit proof that something is being incorrectly reported on your credit reports and the credit bureaus will remove the mistake.

This is a large part of credit repair, since even errors can harm your credit score and removing them can help rebuild your credit. There are even credit repair companies that you pay to have them help you remove inaccuracies on your credit reports. If you’re interested in this type of credit repair service, check out our trusted partner.

2) Pay Your Bills on Time

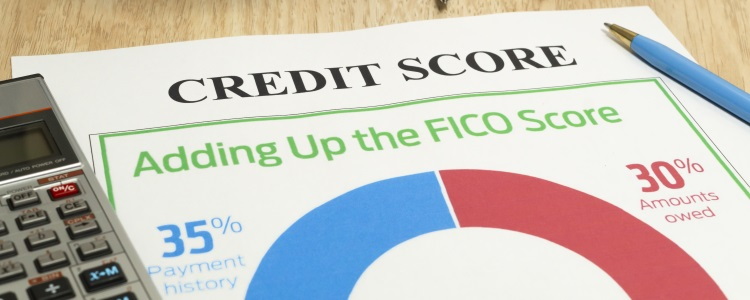

Paying your bills on time can sometimes be easier said than done, but it’s absolutely paramount in repairing your credit. Your payment history is the largest factor that makes up your FICO credit score. Remember that an auto lender’s main concern is whether or not the car loan is going to be repaid, so your history of how you’ve handled past accounts holds high importance to them as well.

One missed or late payment can remain on your credit reports for up to seven years, which isn’t ideal. The more that a payment is late, the more of a negative impact it can have on your credit. If you have any delinquent accounts, work to get those resolved as soon as possible.

The good news is that negative hits on your credit don’t stay there forever – even things like bankruptcies and repossessions. Even if your credit score has lots of negative accounts or missed payments, if you start working on your credit now, the bad marks do eventually fall off your reports.

3) Pay Down Your Credit Cards

Credit cards are a form of revolving credit, which means you always have a limit on how much you can borrow, and if you do borrow, you owe a minimum monthly payment until that balance is paid off.

When it comes to your credit score, credit cards count toward something called your credit utilization ratio. This factors in how much you’re allowed to borrow, compared to how much you currently owe across your credit cards.

If you owe more than 30% of your total credit limit, it’s likely harming your score. This is because the FICO credit scoring model considers a high credit utilization ratio as high risk, indicating that the borrower is overextended, and therefore has more of a chance of missing payments.

Most credit experts recommend that you keep your credit cards below 30% of their credit limits. Pay down your credit cards as much as you can, and once your balance is reported, it can help improve your credit score.

Your credit cards can also factor into your debt to income ratio, which is something else that auto lenders look at before considering you for a car loan. If you owe too much on other accounts, a lender may not approve you for an installment loan because too much of your income may be tied up in repaying your other debts.

4) Keep Old, Unused Accounts Open

If you have old, unused credit cards or lines of credit open but you aren’t using them, you may think that closing them could help improve your credit score. In fact, the opposite is true!

Remember the credit utilization ratio? Closing a credit card account can lower the amount you’re allowed to borrow, and could raise your credit utilization ratio and possibly harm your credit score.

Additionally, there's a factor in the credit scoring model called “length of credit history,” which considers the age of all your credit accounts. The longer you’ve had an account open, the better off your credit score is.

Closing an account can also impact your credit mix, which keeps track of the variety of credit that you have on your reports. So, if you only have one credit card and one auto loan, closing the credit card can hurt your credit mix, and stand to lower your credit score.

5) Apply for New Credit in a Short Window

Before you apply for any new credit, keep in mind that when a lender pulls your credit reports, it can lower your credit score slightly. This is called a hard inquiry, and it stays on your credit reports for up to two years, but can only impact your credit score for up to 12 months.

However, if you apply with multiple lenders for the same type of credit within 14 days, only one hard inquiry is reflected on your credit score. This is called rate shopping.

Once you have your credit score in the range that you want, do all your car loan applications within two weeks to lessen the impact of your newly rebuilt credit score.

Ready for Your Next Car Loan Now?

There are times when waiting for your credit score to return to its glory just isn’t plausible, and you need a vehicle now. But with a tarnished credit score, finding a lender that’s willing to work with you can be challenging. If you have a bad credit score and need an auto loan, get with us at Auto Credit Express.

We have a nationwide network of dealerships that are signed up with bad credit car lenders through their special financing departments. To get matched to a dealer in your area, fill out our free auto loan request form.