When you have bad credit, you may not know where to start with credit repair. Credit repair doesn't have to be difficult, but it does take time. There are, however, a few simple things that you can do to begin improving your credit score right now.

Know Where Your Credit Stands

Before you start repairing your credit, you need to know where it stands. To do this, begin by getting a copy of your credit reports from each of the three national credit bureaus: TransUnion, Experian, and Equifax. You can get your credit reports from each agency once every 12 months for free by visiting www.annualcreditreport.com.

Before you start repairing your credit, you need to know where it stands. To do this, begin by getting a copy of your credit reports from each of the three national credit bureaus: TransUnion, Experian, and Equifax. You can get your credit reports from each agency once every 12 months for free by visiting www.annualcreditreport.com.

You should also get your credit score. The most commonly used score among lenders is the FICO credit score. It's typically available for free from your bank, credit union, or credit card company. If not, there are many credit score services you can use around the web – some are free, some are not.

Once you know where you stand credit-wise, you should check your credit reports carefully for errors, such as negative credit accounts listed that should have already dropped off, or information that isn't yours. Having mistakes on your credit reports fixed can improve your credit score.

Simple Fixes for Credit Improvement

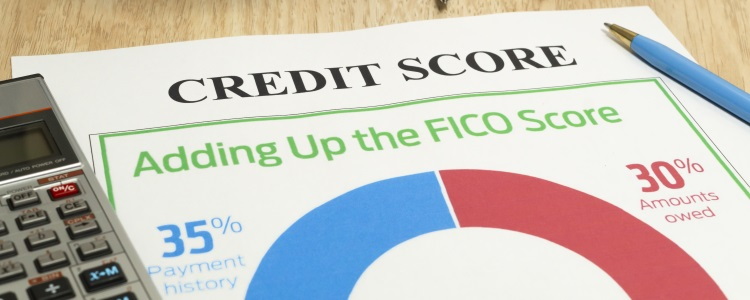

There are a few areas on your credit reports that you should pay careful attention to: payment history and amounts owed. These are only two of the five factors that make up your credit score, but, together, they account for 65% of your score.

Let's take a look at what they mean, and how making small adjustments and creating good habits can help you improve your credit score:

- Payment history – This makes up 35% of your FICO credit score, and it's easy to get this metric on track. All you have to do is start paying all of your bills on time. If that seems like an impossible task, start by making a list of all of your bills and see which ones you have the most trouble with. If you notice a trend, or a specific bill that you're usually behind on, see what you or the creditor can do to make that payment easier. A good tip to remember is that your creditors aren't the enemy. If you're having trouble keeping up, there's no guarantee they can help, but there's nothing wrong with asking.

- Amounts owed – This factor makes up 30% of your FICO credit score, and it looks at how much debt you have and how much of your available credit you're using on revolving accounts. The comparison of credit used to credit available is called your credit utilization ratio. The rule of thumb is that your credit score is negatively impacted when you're using 30% or more of your available credit at any given time. To calculate how much of your credit you're using, add up the total amount of your balances across all of your credit cards and divide the total by your total credit limits across all of your credit cards. If you find that your credit utilization is high, bringing it down can improve your credit score.

Auto Credit Express Tip: Keep in mind that you should only charge what you could buy in cash. This is a good way to avoid overspending. If you're trying to repair your credit by paying off some of your credit cards, remember not to close them (or not to close all of them). Length of credit history is another factor that makes up your credit score, so keeping your oldest cards open and using them responsibly can lead to credit score improvement over time.

Auto Loans Can Help You Repair Your Credit, Too

Another good way to work on credit repair is by adding a new line of credit, such as an auto loan. Getting a bad credit car loan not only adds a new line of installment credit to your credit reports, it gets you the vehicle you need and an opportunity to build a good payment history.

When you have bad credit, you usually can't go to just any dealership to get an auto loan, and it can be hard to know just where to go, but that's where we come in. At Auto Credit Express, we've been helping credit-challenged consumers get connected to the right kinds of dealers for over 20 years.

Let us help you find a dealership in your area that has lenders who can work with people with less than perfect credit. Simply fill out our easy, no-obligation car loan request form to get started right now.