More and more consumers are trading in their cars when they still owe more than they're worth. And the negative equity amounts continue to increase. This is a dangerous trend that has consequences which can snowball, especially if you are dealing with less than perfect credit.

Negative Equity Levels Reach Record Highs

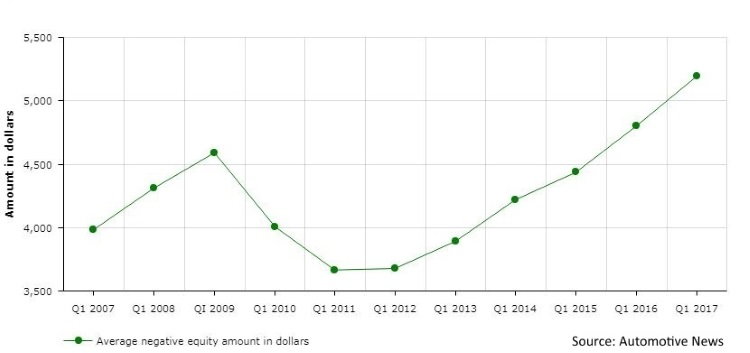

Data from Edmunds shows that consumers are increasingly trading in their cars when they still owe more than their appraised values. In the first three months of 2017, the percentage of trade-ins on a new car purchase that had negative equity reached a record-high 32.8%. The average amount of negative equity of $5,195 also was a record.

When you have negative equity in a vehicle, it simply means that the amount you still owe on the car is greater than what it is actually worth. For example, if your car loan balance is $9,000, but your vehicle's actual cash value is only $6,000, you would have $3,000 in negative equity.

Here is a graph that shows just how much the average amount of negative equity has increased over the last 10 years.

Why Is This Happening?

Automotive News, and others in the industry, believes there are three main reasons why more people are upside down.

- Rising Transaction Prices - For starters, new cars are more expensive than ever. On top of that, a strong economy since the end of the recession is leading consumers to purchase more expensive vehicles. This is evident when you look at how well crossovers and SUVs are selling. Per Edmunds, the average new car transaction price in the first quarter of 2017 was up 3.8% over last year.

- Longer Loan Terms - Because cars are more expensive, consumers combat this by taking out extended loans. They are stretching the terms in order to receive a lower monthly payment. At the end of last year, Experian data showed that loan terms of 73-84 months accounted for almost one third of all new car loans. A longer loan may make the monthly payment lower, but it also causes you to be underwater in the loan for much longer.

- Used Car Values are Falling - The average amount of negative equity is also on the rise because consumers are getting less for their trade-ins. The numbers from vehicle valuation services show that used car values are on the decline, partially because off-lease vehicles continue to flood the market.

What Can Be Done

Despite these factors, close to a third of consumers continue to trade in cars that are worth less than the loan balance. But this also means that the majority of consumers are avoiding this problematic practice. You can too.

In order to do so, you simply need to plan ahead before your next car purchase.

- Buy a Car that Fits Your Budget - If you are extending the loan term beyond five years or more just to be able to afford the monthly payment, the car may be too expensive for you. A good tip is to use the payment to income ratio calculation. Your car and insurance payment should not account for more than 20% of your monthly income.

- Keep the Term Short for Increased Flexibility - Extending your loan term may lower your monthly payment, but it also means you end up paying more in the long run and will be upside down for longer.

- Make a Large Down Payment - A large down payment will reduce the amount of time you are underwater in your loan, and it might help you avoid the situation altogether. This is because it reduces the loan balance, which also means that you pay less in interest charges. When you are paying less in interest, more of your payment can go towards reducing the loan balance.

The Bottom Line

The team here at Auto Credit Express thinks there are very few situations where it's a good idea to trade in a car that's worth less than the loan balance. Trading in a vehicle in which you have negative equity can trap you in a cycle where it happens over and over again. With a little planning and prep work, you can make sure you never have to deal with this scenario.

Finally, if you're ready to buy a car but your credit is keeping you from getting financed, Auto Credit Express wants to help. Our fast and free service can connect you with a local dealership that knows how to assist people who are dealing with credit issues.

See what we can do for you by completing our car loan request form today.