There’s no easy answer to the question of if an auto loan will hurt your credit. It could, if you’re not careful, but a car loan can also be a great tool for building credit.

Car Loans and Damage to Your Credit

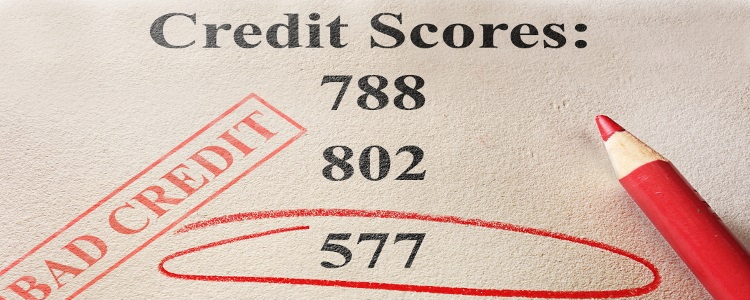

Credit is a two-headed beast: a credit score and a credit report. Your credit score is a number ranging from 300 to 850, which is constantly changing. Your credit report is a record of your credit, both good and bad, spanning the past 10 years.

Credit Scores

The FICO scoring model is used most commonly by lenders as a source of credit scores, and small dips can be expected when you apply for credit of any kind, including a car loan. Over time, these numbers usually bounce back.

The FICO scoring model is used most commonly by lenders as a source of credit scores, and small dips can be expected when you apply for credit of any kind, including a car loan. Over time, these numbers usually bounce back.

Because credit scores can fluctuate so much, there’s a rate shopping window for consumers who are looking for the best interest rates on things like vehicles and mortgages. This allows you to apply for multiple quotes without suffering through multiple hits to your credit score. The window typically lasts 14 to 45 days.

Credit Reports

Looking into your credit reports helps lenders determine your creditworthiness. Credit reports show lenders how you’re handling your credit accounts and how you’ve handled them in the past. They include a history of how you pay your bills, current loans, and any additional information including any past repossessions or bankruptcies.

Negative information on your credit reports, such as bankruptcy, repossession, and unpaid bills, can lower your credit score. So can mistakes, like accounts that should’ve fallen off your report, or lines of credit that you didn’t apply for. Mistakes should be disputed with the credit bureaus for correction or removal. These are just a few reasons it’s important to always know what’s in your credit reports.

Keeping up with your credit reports is a simple process. You’re entitled to receive one free copy of your reports from each of the three national credit bureaus – TransUnion, Experian, and Equifax – every 12 months by visiting AnnualCreditReport.com. Checking your credit yourself doesn’t impact your credit score.

Building Your Credit with a Car Loan

The impact of negative marks on your credit reports will lessen over time, and eventually stop affecting your credit altogether. Some of the more severe things, like repossession and bankruptcy, can take up to 10 years to fall off your credit files.

Fortunately, you can recover from negative credit. One of the best ways to do this is to use your credit responsibly. That’s why a bad credit car loan can be such a great tool. When you pay your bills on time and in full every month, your credit should begin improving. This goes for all your bills, not just your car loan. The more positive payment history you establish, the better.

Where to Turn When the Time is Right

So, car loans can damage credit, if you’re not responsible with your loan. But at the same time, successfully completing a car loan can be one of the best ways to raise your credit if you’re struggling with a lower credit score. The key is to find the right lender for your situation.

Typically, this means using a subprime lender. These lenders only work through special finance dealers, and can’t be approached for direct loans. But, not all dealers use these types of lenders. So, how do you know where to go? With the help of Auto Credit Express, of course!

We work with a large network of special finance dealers all across the US that have the lenders you need. To get started today, simply fill out our fast and free auto loan request form online, and we’ll get to work matching you with a dealer in your area.