Financing a car with workers' compensation benefits isn't impossible, but it's going to be tough to do if you have bad credit.

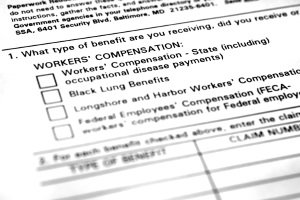

Proving Income for a Car Loan

It can be stressful to think about having to purchase a big ticket item like a vehicle when your primary source of income has been temporarily replaced by workers' comp.

It can be stressful to think about having to purchase a big ticket item like a vehicle when your primary source of income has been temporarily replaced by workers' comp.

The temporary status of workers' compensation wages is the main issue when trying to get a car loan. This is a problem because lenders, especially subprime lenders that offer bad credit auto loans, typically require buyers to be regular W-2 employees.

Workers' comp, like other forms of "unearned" income – including disability and unemployment – usually cannot be used as proof of income when you apply for a bad credit car loan because they're either non-taxable or not permanent.

In order for these forms of income to be used to qualify for financing, they have to be accompanied by some form of "earned" or taxable income that meets a lender’s minimum requirements. Lenders like to have proof of wages that can be garnished, just in case they would need to cover a loss.

Getting a Workers' Comp Car Loan

If workers' compensation wages are your only form of income at the moment, you may not be totally out of luck getting the auto loan you need, but that's going to depend on the lender you work with.

In some cases, special finance dealers and the lenders they're signed up with may work with workers' comp wages if they continue throughout your entire loan term and/or:

- You have retained your employment

- You have a large down payment

Because workers' compensation is typically a short-term payment option, having the payments cover your entire loan term may be difficult unless you're on long-term disability. It may also depend on where you live, because the limitations of workers' comp are set per state.

Workers' compensation, even permanent disability, doesn't mean that you're unable to work indefinitely. It just means that you're unable to return to work in the same capacity as before, or that you're unable to work without restriction per a doctor’s order.

There are a few ways to boost your chances of getting car financing with bad credit and workers' comp wages. You could bring an additional form on income to the table, such as from a part-time job or other taxable source, or get a co-borrower to take out a loan with you.

Note that a co-borrower is someone, typically a spouse, with whom you combine incomes for the purpose of meeting a lender’s requirement. They aren't the same as a cosigner, who can help you in terms of meeting a credit requirement. Cosigner income can’t be combined with yours, and therefore can't be used to meet the income requirement.

Using the Right Lender

Another thing that helps you get the auto loan you need when you have workers' compensation wages and poor credit is to make sure you're working with a dealership that has the ability to help people in your type of situation.

Not all dealers can help bad credit borrowers, regardless of their income situation. To save yourself the stress of finding the right dealership by driving all over town, why not let us help instead?

Here at Auto Credit Express, we work with a nationwide network of dealers that can help borrowers in unique situations. To get started right now, simply fill out our car loan request form and we'll get to work matching you to a local dealership!