Car buyers with problem credit looking for auto loan approvals need to understand that there really are no shortcuts when it comes to credit repair although there are scammers ready to take their money for those who believe otherwise

Our experience

Consumers with damaged credit frequently want to know if there is a quicker way, other than taking out a car loan, that they can raise their FICO scores.

Here at Auto Credit Express the answer we usually give them is probably not what they want to hear. We know it isn't because for over two decades we've been helping car shoppers with bad credit looking for online auto loans find those new car dealers that can offer them their best chances for loan approvals.

It's also the reason our website includes much more than a credit application - so that car shoppers can learn why many of the so-called shortcuts to credit repair can get them into big trouble.

Credit repair

For credit-challenged consumers hoping to raise their credit scores including those who have recently completed a personal bankruptcy, we can see how the idea of quickly boosting their credit scores can be very appealing.

Knowing this, a few in the credit repair business have been known to promise that they can cure anyone's credit woes nearly instantly. In some cases this involves showing consumers how they can create a new identity for themselves. But this so-called solution will only lead to trouble.

Understanding file segregation

The process they're suggesting is called file segregation and this is usually how the scam plays out: A credit repair agency will send out letters targeted to people that have recently completed bankruptcy. These letters typically tell recipients that due to the bankruptcy they've just completed they'll be unable to get a credit card, personal loan or most any other type of credit for 10 years (a claim that is totally false).

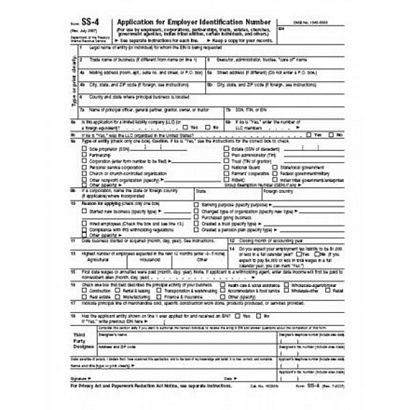

The letter goes on to explain that to prevent this from happening, their company will, for a fee, show how this bankruptcy can be hidden by the creation of a new identity. Bankruptcy filers can then use this new identity to apply for new credit accounts. Once filers sign up for this service the credit repair company tells them to apply for an Employer Identification Number from the Internal Revenue Service.

(Note: while an EIN looks like a social security number it's actually an identifier that is issued to businesses so they can report their financial information to both the IRS and the Social Security Administration.)

Once they receive an EIN, these people are directed by the credit repair company to use it instead of a social security number when applying for credit. Doing this separates (segregates) their old credit information from the new credit file they are establishing.

What the credit repair company fails to tell these people is that it's a federal crime to obtain an EIN for personal identification. Not only that, but using a phone or the mail to apply for one means that the applicant could also be charged with mail or wire fraud. In many states it's also considered a civil offense.

As we see it

Consumers with damaged credit should be wary of any company that promises a quick and easy road to credit repair. The best advice we can give you is to follow your instincts. If something sounds too good to be true, it probably is.

One more thing we should point out is that as part of the Credit Repair Organizations Act it is illegal for a company to charge anyone for credit repair services until it's actually been completed.

One more tip: Auto Credit Express specializes in matching applicants with auto credit issues to dealers that can offer them their best chance at getting approved auto loans.

So if you're ready to begin that process, you can start it now by filling out our online auto loan application.