The average loan amount and loan term for both new and used cars continues to rise, but consumers are getting at least one thing right. The latest data from Edmunds shows that consumers are making larger down payments on their auto loans.

Edmunds' Analysis

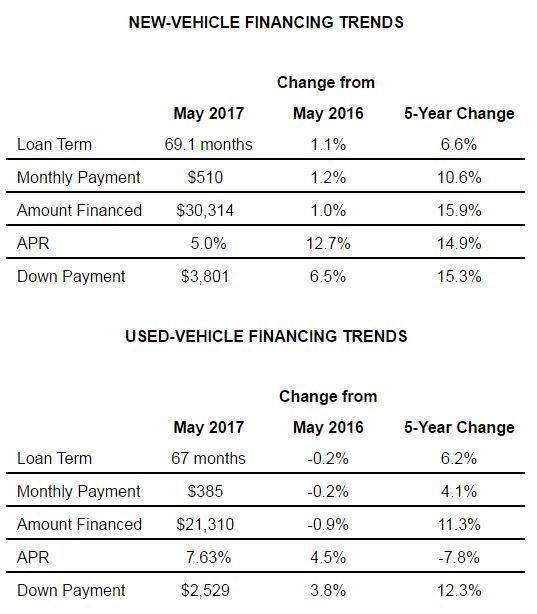

According to a new analysis from Edmunds, the average new car down payment reached $3,801 in May. This is the fourth-highest mark for a month on record. The record of $3,951 came in December of 2012.

The May 2017 average new car down payment amount of $3,801 is a 6.5% increase from a year ago. It's also an increase of $504 from five years ago.

The May 2017 average new car down payment amount of $3,801 is a 6.5% increase from a year ago. It's also an increase of $504 from five years ago.

Down payments were also up on used car loans. Edmunds data showed that the average down payment for a used vehicle in May was $2,529. That's $93 more than a year earlier — a 3.8% increase.

Edmunds believes that the near-record average down payment is a result of rising vehicle prices, climbing interest rates, and consumer's desire to have the latest and greatest features. It doesn't hurt that the economy is strong right now, either.

The analysis highlighted the fact that the average loan term, monthly payment, and amount financed on new car loans have all steadily grown over the last half decade. Consumers are showing they are practical by combating these factors by putting more money down.

The Benefits of Making a Down Payment on a Car Loan

Edmunds' analysis shows that, while they are clearly willing to spend more for the vehicle they want, consumers are being sensible by increasing the size of their down payments.

We call it smart, as there are a lot of benefits to making a down payment on a car loan. In fact, a down payment:

- Reduces the amount you need to finance, which lowers your monthly payment and the amount of interest charges you end up paying.

- Makes shortening the loan term easier. While this will raise the monthly payment, it reduces the total cost because you'll pay less in interest.

- Shows the lender you are committed to paying back the loan.

- Makes it easier for you to build equity and reduces the amount of time that you'll be upside down in the loan.

- If you have bad credit, it also increases your chances of getting approved.

The Bottom Line

A down payment can help you save money and start your loan off on the right foot. Saving up for one well in advance of applying for a car loan is a smart thing to do, especially if you are dealing with credit problems.

Auto Credit Express can help credit-challenged consumers find financing with our fast and free service. We connect car buyers to local special finance dealerships that know how to handle unique situations.

You can be next if you start by completing our car loan request form.