Bad credit car loans are for people whose credit scores or financial situations don't qualify for traditional lending, including a direct loan through a bank or credit union. Why you, specifically, need a bad credit auto loan isn't a question we can answer. Typically, no matter how you got into the situation that has led to the need for a bad credit car loan, there's a way out.

Knowing that an auto loan is possible, take a minute to think about how you got into this situation. Looking at where you are credit-wise can make a difference in where you're going when it comes to getting financed with bad credit.

Know Your Credit

There are likely many different reasons for why and how you got into the bad credit situation you find yourself in. Before you jump into a car loan, bad credit or not, it's a good idea to check your credit reports so you understand why your credit score is what it is.

To check your credit reports, you can request a copy from each of the three national credit bureaus – Experian, TransUnion, and Equifax – once every 12 months at www.annualcreditreport.com.

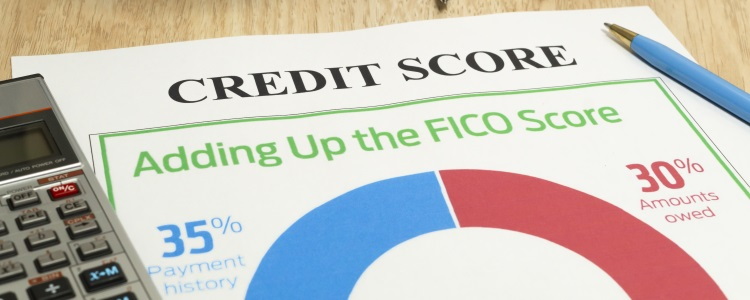

Looking at your credit reports can help you see what lenders are looking at when they're considering your application. This is because there are five factors that make up your credit score, and the details of each factor can be found in your credit reports. Keep in mind, there are different types of credit scoring models out there, but the one used most often by lenders is FICO.

Let's breakdown the five factors that go into your FICO credit score and how heavily each affects it:

Payment history: 35% – This is the most important factor in determining your credit. Lenders look at how well you've handled credit in the past. Think about it: how good have you been at making every payment on time over the past seven years? If the answer is that you haven't, or that you're not very good at making on-time payments, you should really think about this before considering financing a vehicle.

Payment history: 35% – This is the most important factor in determining your credit. Lenders look at how well you've handled credit in the past. Think about it: how good have you been at making every payment on time over the past seven years? If the answer is that you haven't, or that you're not very good at making on-time payments, you should really think about this before considering financing a vehicle.- Amounts owed: 30% – This part of your credit looks at how much debt you have, and a large part of it has to do with your credit utilization ratio. Your credit utilization ratio is simply the sum of all of your credit card balances divided by your limits. Typically, your credit utilization ratio starts to negatively impact your credit in a significant way when it's above 30%. If you find yourself maxing out credit cards, or only being able to make minimum payments rather than paying off your balance monthly, you might be spending beyond your means.

- Length of credit history: 15%– How long have you been using credit? That question is answered here, and the longer you've had credit, the better. If you're trying to improve your credit by cutting down on the number of credit cards you have, you should consider keeping one or two of the oldest ones you have, and maintain their accounts in good standing. Use your credit cards, but pay off the balances or keep them at or below 30% of their limits each month to get the most out of this credit factor.

- Credit mix: 10% – Balancing a mix of installment credit, such as auto loans and mortgages, with revolving credit, like credit cards, let's lenders know that you can handle both types of credit, and gives them more confidence to approve you for a loan.

- New credit: 10% – When you apply for new credit, it should be done responsibly, as needed, and not all at once. If you decide to apply for every credit card under the sun all at once, and do this every few months, this is a red flag for lenders. Not to mention, all the hard inquiries are going to negatively affect your credit score. Lenders like to see that you apply for credit when you need something, and then responsibly manage the account. That said, if you're applying for a loan for something specific, you can apply with multiple different lenders within a 14-day period. This is known as the rate shopping window, and the credit bureaus know that you're looking for the best rate on a specific type of credit. Therefore, all hard inquiries made for the same type of credit made within the window only count against your credit score as a single hard inquiry.

Even though they all carry a different weight, they're all important. Neglecting any one of these can drag down your credit score faster than you realize. Fortunately, credit isn't something set in stone, and it can always be improved.

Auto Credit Express Tip: As you look at your credit reports, pay attention to any errors you find or derogatory accounts that are more than seven years old but still listed. Dispute these items with the reporting bureau(s) so they can investigate and remove them. Simply having errors removed can make small improvements in your credit score.

Do You Have a Bad Credit Habit?

There are two types of bad credit: habitual and situational. Lenders know how to tell the difference when they look at your credit reports, and you should, too. Now that you know what to look for, ask yourself this: "Do I have a habit of bad credit?"

Habitual bad credit is quite common. Many things contribute to this, and it can be difficult to recognize. For example, it can happen if your utilities aren't paid on time, or you make partial payments on all your bills with every check, just to stretch through. Maybe you've filed bankruptcy more than once, or had a car or two repossessed. These are all signs of poor long-term financial habits, and they could mean trouble when you apply for an auto loan.

Situational bad credit, on the other hand, is caused by a (usually) temporary setback and easily recognizable by the sudden appearance of poor credit habits in an otherwise good record. Things outside of your control that can cause this include job loss, illness, injury, or divorce. If one or more of these unexpected situations caused a credit spiral, and you otherwise have an established history of responsibly managing credit, then you have situational bad credit.

Overcoming Bad Credit

There are countless ways to overcome bad credit, and you just need to make sure your solution addresses the cause of your credit issues. If on-time payments are an issue for you, a car loan can be an excellent way to improve your credit – as long as you keep up with the payments. But, you have to begin making an effort to pay your other bills on time, as well.

When you have bad credit, however, it's not the time to try for an auto loan because you want the newest sports car, or a specific make and model you've been dreaming of. If part of what got you into a bad credit was living beyond your means, you want to make sure that any vehicle you get is a necessary purchase. When you get a bad credit auto loan, you should make sure the payment fits comfortably in your budget, and that the car is reliable, meets your needs, and holds its value.

We Can Help You Find a Car Loan

At Auto Credit Express, we work with a nationwide network of special finance dealers that help people like you, who suffer with bad credit, get the lending they need. The dealerships in our network work with subprime lenders that specialize in helping bad credit car buyers by looking beyond their credit score to other qualifiers such as income, residence stability, and employment.

If you're serious about turning your credit around, and you need a vehicle to get you through while you work on improving your credit, we want to help connect you to a local dealer that can help. To get the process started, simply fill out our fast and free auto loan request form right now.